Is Equipment An Asset Or Expense . equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. Expenses are the resource that a company already consume. examples of fixed assets. The difference between assets and fixed assets. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. assets are the resource that companies expect to use in the future. Fixed assets can be recorded.

from www.chegg.com

examples of fixed assets. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. assets are the resource that companies expect to use in the future. Expenses are the resource that a company already consume. Fixed assets can be recorded. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. The difference between assets and fixed assets.

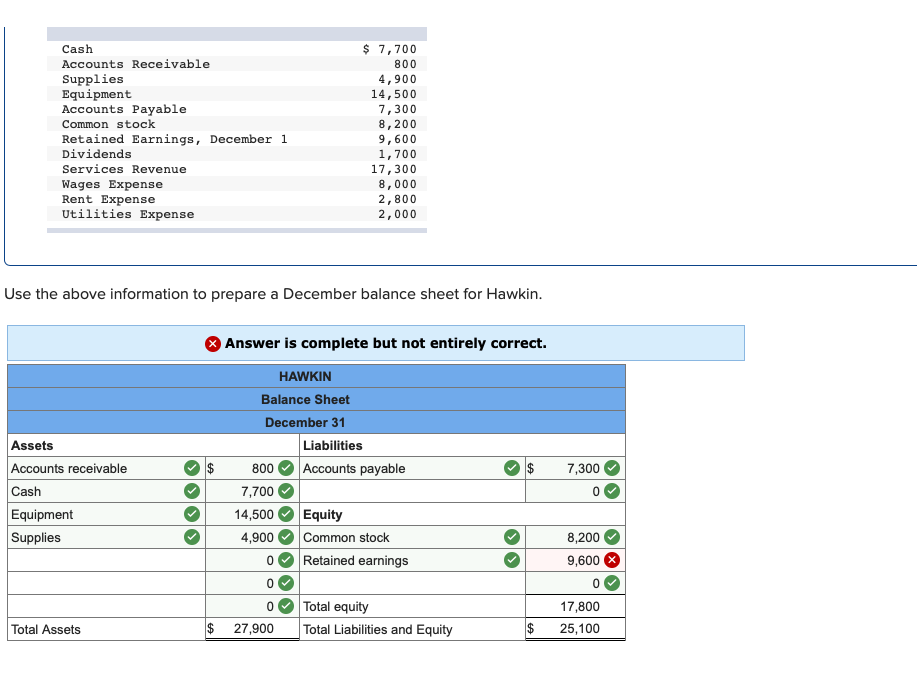

Solved Cash Accounts Receivable Supplies Equipment Accounts

Is Equipment An Asset Or Expense depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. assets are the resource that companies expect to use in the future. examples of fixed assets. The difference between assets and fixed assets. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. Fixed assets can be recorded. Expenses are the resource that a company already consume.

From exolitjgf.blob.core.windows.net

Office Equipment An Asset Or Expense at Theresa Kirkland blog Is Equipment An Asset Or Expense examples of fixed assets. The difference between assets and fixed assets. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. Fixed assets can be recorded. assets are the resource that companies expect to use in the future. Expenses are the resource that a company already consume. equipment. Is Equipment An Asset Or Expense.

From www.accountingcoaching.online

Expenses vs. Assets What is the Difference? AccountingCoaching Is Equipment An Asset Or Expense assets are the resource that companies expect to use in the future. Expenses are the resource that a company already consume. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. The difference between assets and fixed assets. Fixed assets can be recorded. depreciation expense is the. Is Equipment An Asset Or Expense.

From exobehtve.blob.core.windows.net

The Journal Entry To Record Depreciation Expense For A Piece Of Is Equipment An Asset Or Expense equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. assets are the resource that companies expect to use in the future. examples of fixed assets. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. Expenses are. Is Equipment An Asset Or Expense.

From www.chegg.com

Solved Cash Accounts Receivable Supplies Equipment Accounts Is Equipment An Asset Or Expense examples of fixed assets. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. Expenses are the resource that a company already consume. assets are the resource that companies expect to use in the future. The difference between assets and fixed assets. equipment is a fixed asset that. Is Equipment An Asset Or Expense.

From www.tianlong.com.sg

An overview of Bookkeeping Tianlong Services Is Equipment An Asset Or Expense equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. Fixed assets can be recorded. assets are the resource that companies expect to use in the future. The difference. Is Equipment An Asset Or Expense.

From www.fotolog.com

Personal Asset and Liability Management To Boost Net Worth FotoLog Is Equipment An Asset Or Expense The difference between assets and fixed assets. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. Fixed assets can be recorded. Expenses are the resource that a company already consume. examples of fixed assets. assets are the resource that companies expect to use in the future.. Is Equipment An Asset Or Expense.

From www.chegg.com

Solved Assets Cash Office Supplies and Salaries Expense Is Equipment An Asset Or Expense examples of fixed assets. Expenses are the resource that a company already consume. The difference between assets and fixed assets. assets are the resource that companies expect to use in the future. Fixed assets can be recorded. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory.. Is Equipment An Asset Or Expense.

From www.investopedia.com

Prepaid Expense Definition and Example Is Equipment An Asset Or Expense Fixed assets can be recorded. assets are the resource that companies expect to use in the future. The difference between assets and fixed assets. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. Expenses are the resource that a company already consume. equipment is a fixed asset that. Is Equipment An Asset Or Expense.

From exocdyozs.blob.core.windows.net

Office Equipment Cost Accounting at Gregory Fisher blog Is Equipment An Asset Or Expense Expenses are the resource that a company already consume. assets are the resource that companies expect to use in the future. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. The difference between assets and fixed assets. equipment is a fixed asset that provides value for more than. Is Equipment An Asset Or Expense.

From accountingo.org

Difference between Assets and Expenses Accountingo Is Equipment An Asset Or Expense Expenses are the resource that a company already consume. examples of fixed assets. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. assets are the resource that companies expect to use in the future. The difference between assets and fixed assets. Fixed assets can be recorded.. Is Equipment An Asset Or Expense.

From www.principlesofaccounting.com

How Transactions Impact the Accounting Equation Is Equipment An Asset Or Expense depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. The difference between assets and fixed assets. assets are the resource that companies expect to use in the future. Expenses are the resource that a company already consume. equipment is a fixed asset that provides value for more than. Is Equipment An Asset Or Expense.

From corporatefinanceinstitute.com

PP&E (Property, Plant & Equipment) Overview, Formula, Examples Is Equipment An Asset Or Expense examples of fixed assets. The difference between assets and fixed assets. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. Fixed assets can be recorded. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. assets are. Is Equipment An Asset Or Expense.

From dxowjjual.blob.core.windows.net

Is Property And Equipment A Noncurrent Asset at Joaquin Stone blog Is Equipment An Asset Or Expense assets are the resource that companies expect to use in the future. Fixed assets can be recorded. examples of fixed assets. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. Expenses are the resource that a company already consume. depreciation expense is the amount of. Is Equipment An Asset Or Expense.

From www.youtube.com

Asset method vs Expense method YouTube Is Equipment An Asset Or Expense Expenses are the resource that a company already consume. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. examples of fixed assets. The difference between assets and fixed assets. equipment is a fixed asset that provides value for more than one year and is charged to expense or. Is Equipment An Asset Or Expense.

From businessyield.com

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should Is Equipment An Asset Or Expense assets are the resource that companies expect to use in the future. Fixed assets can be recorded. examples of fixed assets. The difference between assets and fixed assets. Expenses are the resource that a company already consume. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. equipment. Is Equipment An Asset Or Expense.

From dxoxtqxpc.blob.core.windows.net

Where Does Utilities Go On A Balance Sheet at Tim Dike blog Is Equipment An Asset Or Expense Expenses are the resource that a company already consume. The difference between assets and fixed assets. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. examples of fixed. Is Equipment An Asset Or Expense.

From exoujfitw.blob.core.windows.net

What Is Accumulated Depreciation Equipment On A Balance Sheet at Idell Is Equipment An Asset Or Expense examples of fixed assets. Expenses are the resource that a company already consume. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. assets are the resource that. Is Equipment An Asset Or Expense.

From dxozecmjo.blob.core.windows.net

Is Equipment Purchase An Expense at Christopher Duffy blog Is Equipment An Asset Or Expense Fixed assets can be recorded. depreciation expense is the amount of the asset’s cost to be recognized, or expensed, in the current period. assets are the resource that companies expect to use in the future. equipment is a fixed asset that provides value for more than one year and is charged to expense or inventory. The difference. Is Equipment An Asset Or Expense.